Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.

An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer’s promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ownership, possession, or pre-existing relationship.

The insured receives a contract, called the insurance policy, which details the conditions and circumstances under which the insurer will compensate the insured, or their designated beneficiary or assignee. The amount of money charged by the insurer to the policyholder for the coverage set forth in the insurance policy is called the premium. If the insured experiences a loss which is potentially covered by the insurance policy, the insured submits a claim to the insurer for processing by a claims adjuster. A mandatory out-of-pocket expense required by an insurance policy before an insurer will pay a claim is called a deductible (or if required by a health insurance policy, a copayment). The insurer may hedge its own risk by taking out reinsurance, whereby another insurance company agrees to carry some of the risks, especially if the primary insurer deems the risk too large for it to carry.

History[edit]

Early methods[edit]

Merchants have sought methods to minimize risks since early times. Pictured, Governors of the Wine Merchant’s Guild by Ferdinand Bol, c. 1680.

Methods for transferring or distributing risk were practiced by Babylonian, Chinese and Indian traders as long ago as the 3rd and 2nd millennia BC, respectively.[1][2] Chinese merchants travelling treacherous river rapids would redistribute their wares across many vessels to limit the loss due to any single vessel capsizing.

Codex Hammurabi Law 238 (c. 1755–1750 BC) stipulated that a sea captain, ship-manager, or ship charterer that saved a ship from total loss was only required to pay one-half the value of the ship to the ship-owner.[3][4][5] In the Digesta seu Pandectae (533), the second volume of the codification of laws ordered by Justinian I (527–565), a legal opinion written by the Roman jurist Paulus in 235 AD was included about the Lex Rhodia (“Rhodian law”). It articulates the general average principle of marine insurance established on the island of Rhodes in approximately 1000 to 800 BC, plausibly by the Phoenicians during the proposed Dorian invasion and emergence of the purported Sea Peoples during the Greek Dark Ages (c. 1100–c. 750).[6][7][8]

The law of general average is the fundamental principle that underlies all insurance.[7] In 1816, an archeological excavation in Minya, Egypt produced a Nerva–Antonine dynasty-era tablet from the ruins of the Temple of Antinous in Antinoöpolis, Aegyptus. The tablet prescribed the rules and membership dues of a burial society collegium established in Lanuvium, Italia in approximately 133 AD during the reign of Hadrian (117–138) of the Roman Empire.[7] In 1851 AD, future U.S. Supreme Court Associate Justice Joseph P. Bradley (1870–1892 AD), once employed as an actuary for the Mutual Benefit Life Insurance Company, submitted an article to the Journal of the Institute of Actuaries. His article detailed an historical account of a Severan dynasty-era life table compiled by the Roman jurist Ulpian in approximately 220 AD that was also included in the Digesta.[9]

Concepts of insurance has been also found in 3rd century BC Hindu scriptures such as Dharmasastra, Arthashastra and Manusmriti.[10] The ancient Greeks had marine loans. Money was advanced on a ship or cargo, to be repaid with large interest if the voyage prospers. However, the money would not be repaid at all if the ship were lost, thus making the rate of interest high enough to pay for not only for the use of the capital but also for the risk of losing it (fully described by Demosthenes). Loans of this character have ever since been common in maritime lands under the name of bottomry and respondentia bonds.[11]

The direct insurance of sea-risks for a premium paid independently of loans began in Belgium about 1300 AD.[11]

Separate insurance contracts (i.e., insurance policies not bundled with loans or other kinds of contracts) were invented in Genoa in the 14th century, as were insurance pools backed by pledges of landed estates. The first known insurance contract dates from Genoa in 1347. In the next century, maritime insurance developed widely, and premiums were varied with risks.[12] These new insurance contracts allowed insurance to be separated from investment, a separation of roles that first proved useful in marine insurance.

The earliest known policy of life insurance was made in the Royal Exchange, London, on the 18th of June 1583, for £383, 6s. 8d. for twelve months on the life of William Gibbons.[11]

Modern methods[edit]

Insurance became far more sophisticated in Enlightenment-era Europe, where specialized varieties developed.

Lloyd’s Coffee House was the first organized market for marine insurance.

Property insurance as we know it today can be traced to the Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance “from a matter of convenience into one of urgency, a change of opinion reflected in Sir Christopher Wren‘s inclusion of a site for “the Insurance Office” in his new plan for London in 1667.”[13] A number of attempted fire insurance schemes came to nothing, but in 1681, economist Nicholas Barbon and eleven associates established the first fire insurance company, the “Insurance Office for Houses”, at the back of the Royal Exchange to insure brick and frame homes. Initially, 5,000 homes were insured by his Insurance Office.[14]

At the same time, the first insurance schemes for the underwriting of business ventures became available. By the end of the seventeenth century, London’s growth as a centre for trade was increasing due to the demand for marine insurance. In the late 1680s, Edward Lloyd opened a coffee house, which became the meeting place for parties in the shipping industry wishing to insure cargoes and ships, including those willing to underwrite such ventures. These informal beginnings led to the establishment of the insurance market Lloyd’s of London and several related shipping and insurance businesses.[15]

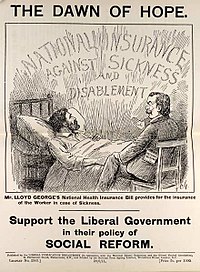

Leaflet promoting the National Insurance Act 1911

Life insurance policies were taken out in the early 18th century. The first company to offer life insurance was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706 by William Talbot and Sir Thomas Allen.[16][17] Upon the same principle, Edward Rowe Mores established the Society for Equitable Assurances on Lives and Survivorship in 1762.

It was the world’s first mutual insurer and it pioneered age based premiums based on mortality rate laying “the framework for scientific insurance practice and development” and “the basis of modern life assurance upon which all life assurance schemes were subsequently based.”[18]

In the late 19th century “accident insurance” began to become available.[19] The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent railway system.

The first international insurance rule was the York Antwerp Rules (YAR) for the distribution of costs between ship and cargo in the event of general average. In 1873 the “Association for the Reform and Codification of the Law of Nations”, the forerunner of the International Law Association (ILA), was founded in Brussels. It published the first YAR in 1890, before switching to the present title of the “International Law Association” in 1895.[20][21]

By the late 19th century governments began to initiate national insurance programs against sickness and old age. Germany built on a tradition of welfare programs in Prussia and Saxony that began as early as in the 1840s. In the 1880s Chancellor Otto von Bismarck introduced old age pensions, accident insurance and medical care that formed the basis for Germany’s welfare state.[22][23] In Britain more extensive legislation was introduced by the Liberal government in the 1911 National Insurance Act. This gave the British working classes the first contributory system of insurance against illness and unemployment.[24] This system was greatly expanded after the Second World War under the influence of the Beveridge Report, to form the first modern welfare state.[22][25]

In 2008, the International Network of Insurance Associations (INIA), then an informal network, became active and it has been succeeded by the Global Federation of Insurance Associations (GFIA), which was formally founded in 2012 to aim to increase insurance industry effectiveness in providing input to international regulatory bodies and to contribute more effectively to the international dialogue on issues of common interest. It consists of its 40 member associations and 1 observer association in 67 countries, which companies account for around 89% of total insurance premiums worldwide.[26]